In Hong Kong, companies pay taxes on their profits in two ways. Under this method, the first HKD 2 million in taxable profits are taxed at a lower rate, even though profits above that amount are taxed at the standard rate.

The two-tiered profits tax rate in Hong Kong is a tax regime introduced in 2018. The main objective behind introducing this tax system was to create a more favorable tax environment for small and medium-sized enterprises (SMEs) and startups while still generating sufficient revenue for the government.

It is important to note that the two-tiered profits tax structure applies only to corporations. Sole proprietorships and partnerships are subject to a 15% flat profit tax on all assessable profits.

This blog will look closer at Two-Tiered Profits Tax Rates in Hong Kong and explore how it benefits businesses.

What are Two-Tiered Profits Tax Rates?

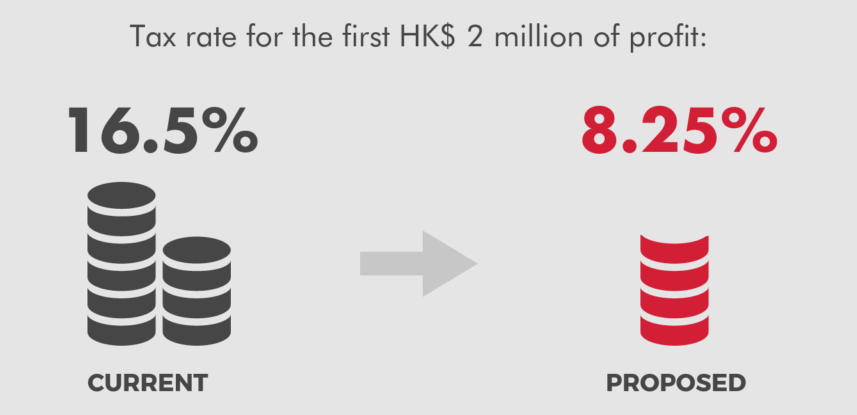

The Two-Tiered Profits Tax Rate is a tax regime that lowers the tax burden for small and medium-sized enterprises (SMEs) and startups in Hong Kong. This system divides businesses into two categories based on their profits. Companies with profits up to HKD 2 million pay 8.25% in taxes, while those with more pay 16.5%.

Due to their inability to compete with larger firms that could take advantage of tax loopholes, small and medium-sized enterprises (SMEs), and startups, it has demanded the setting up of this system. The government hopes that by providing a more favorable tax environment for SMEs and startups, it will encourage more entrepreneurship and innovation, which will, in turn, drive economic growth.

Who is Eligible for Two-Tiered Profits Tax Rates?

The two-tiered profits tax rates are only available to companies that are both Hong Kong-incorporated and have profit attributable to operations conducted in Hong Kong. The company must also satisfy the following conditions:

- The profits of the company do not exceed HKD 2 million;

- The company has not opted for assessment under the standard tax rate; and

- The company is not carrying on any specified business, such as banking, insurance, or financial services.

If a company meets these criteria, it will be subject to a lower tax rate of 8.25%.

Which companies would be eligible for two-tiered profit tax rates in Hong Kong?

In Hong Kong, eligible corporate entities subject to profits tax are subject to two-tiered profits tax rates. In order to qualify for the lower tax rate under the two-tiered system, a company must satisfy the following requirements:

- The corporation must be based in Hong Kong.

- The corporation’s assessable profits for the fiscal year under consideration must not exceed HKD 2 million.

- The corporation must not be linked to any other entity.

- There must be no chargeable capital gains in the corporation.

If a company meets these standards, it can pay an 8.25% profits tax on the first HKD 2 million of assessable profits. Any taxable profits over 2 million will be subject to a 16.5% standard profits tax.

Benefits of Two-Tiered Profits Tax Rates

The Two-Tiered Profits Tax Rate has several benefits for SMEs and startups in Hong Kong. Some of the main benefits are:

- Lower Tax Burden: The lower tax rate of 8.25% is significantly lower than the standard tax rate of 16.5%. This provides much-needed tax relief for SMEs and startups, which often struggle to generate profits early on.

- Encourages Entrepreneurship: By providing a more favorable tax environment for SMEs and startups, the government hopes to encourage more entrepreneurship and innovation. This will help to drive economic growth and create jobs in Hong Kong.

- Simplified Tax System: It is a more straightforward tax system compared to the standard tax rate, which has several exemptions, deductions, and allowances. This simplifies the tax filing process for SMEs and startups, which can save time and money.

- Level Playing Field: The two-tiered profits tax rates help to level the playing field for SMEs and startups, which often struggle to compete with larger corporations that can take advantage of tax loopholes.

Conclusion

The two-tiered profits tax rate is a tax regime that lowers the tax burden for SMEs and startups in Hong Kong. It provides much-needed tax relief, encourages entrepreneurship, simplifies the tax system, and helps to level the playing field for SMEs and startups. The government hopes to drive economic growth and create jobs in Hong Kong by creating a more favorable tax environment for SMEs and startups.

A professional service provider or easyCorp can help you navigate the complete two-tiered profits tax rates system in Hong Kong for companies and comply with all applicable laws.

FAQ:

1. What are the two-tiered profits tax rates?

Companies will be taxed 8.25% on profits up to HK$2 million, instead of the current 16.5%, for profits up to that amount.

2. Does Hong Kong have a Profit tax?

Taxes in Hong Kong are based on a territorial basis. That is to say, only profits earned in Hong Kong through a business, trade, or profession shall be subject to taxation. Profits made outside of Hong Kong are free from the city’s profits tax.

3. What will the corporation tax rate be in Hong Kong in 2023?

16.5 %

In 2023, Hong Kong’s corporate tax rate stayed at 16.5%. The range of rates was from 17% to 16%.

4. What is a tiered rate structure?

Tiered pricing is a pricing strategy allowing you to sell more items at a consistent price point. When your spending reaches a certain threshold, you’ll be upgraded to the next pricing category and charged accordingly. The model and technique of tiered pricing are unique.

5. How is profit tax calculated in Hong Kong?

Rate of taxation and method of calculating profits

Profits up to HKD 2 million are subject to an 8.25% tax rate. The rate for the remaining profit is 16.5%. For sole proprietorships, the tax rate is 7.5% on earnings up to HKD 2 million. As of then on, the charge will be 15%.

Authorship:

This blog article is created by easyCorp business team and audited by chartered experts before publish. We’re dedicated to sharing useful information about setting up business and taxation in Hong Kong.

Founded in 2007, we were awarded as the “Best Business Partner” by HANG SENG Bank; our customers spread throughout Europe, the United States, the Middle East, Asia, Africa and etc.

easyCorp differentiate ourself as a strong incumbent in this market, our problem solving experience and numbers of scenario cases handled are not matchable by other market players. We provide high-quality taxation, accounting, company secretary & business consulting services.