Any Hong Kong company that has conducted business is required to file audited accounts with the Inland Revenue Department. Our experienced team provides one-stop accounting services in Hong Kong, including annual auditing and other complimentary advice services.

All Hong Kong-registered companies must keep accurate accounting records and book business finances, which must be audited annually by a Hong Kong-licensed Certified Public Accountant (CPA) and filed with the Inland Revenue Department (IRD) together with your Profits Tax return.

Every person engaged in trade, profession, or business in Hong Kong is required under Section 51C of the Inland Revenue Ordinance (IRO) to maintain proper records (in English or Chinese) of revenue and expenditure to facilitate the prompt determination of assessable profits.

A minimum of 7 years is required to keep such documents. A maximum fine of HKD100,000 may be imposed for noncompliance with IRO standards in the absence of a good cause.

We’ve compiled this helpful guide with specific recommendations to help you get your business accounting and auditing services in Hong Kong.

Top-Notch Service at Reasonable Costs.

i) Advocacy in Accounting/Auditing Issues and Tax Matters

Hong Kong limited corporations are required by law to prepare annual financial statements and have their records audited by a certified public accountant.

ii) Affordable

Accounting, Auditing, and Tax Filing are the best services we provide for Hong Kong businesses, and we do it all at competitive prices (from a partner, as the accountant cannot be the same as the auditor).

iii) Transparent

We offer pre-made packages for businesses with annual revenue of up to millions of Hong Kong dollars.

If your annual revenue is more than HKD4,000,000, we can customize a quote to your specific needs.

iv) Unique.

What makes us unique:

We offer full-service accounting services, including auditing, tax preparation, and representation.

Our fees are calculated as a percentage of total turnover rather than a flat rate per transaction (and this is good news for you).

We leverage cutting-edge technology to provide cost-effective solutions to our customers’ complicated problems.

In a nutshell, we’ve honed our skills serving customers in the e-commerce domains and the more established trading and service sectors.

We offer annual or continuous accounting services in Hong Kong and auditing services in Hong Kong at your choice and within your budget.

A. Professional Auditing Services in Hong Kong.

1. Preparation of Financial Statements and Annual Auditing

According to the Hong Kong Companies Ordinance, a limited company’s annual financial statements must be audited by a Practicing Certified Public Accountant (CPA) before being submitted to shareholders at the annual meeting and used in the Inland Revenue Department’s yearly tax assessment. EasyCorp delivers annual audits and audited financial statements.

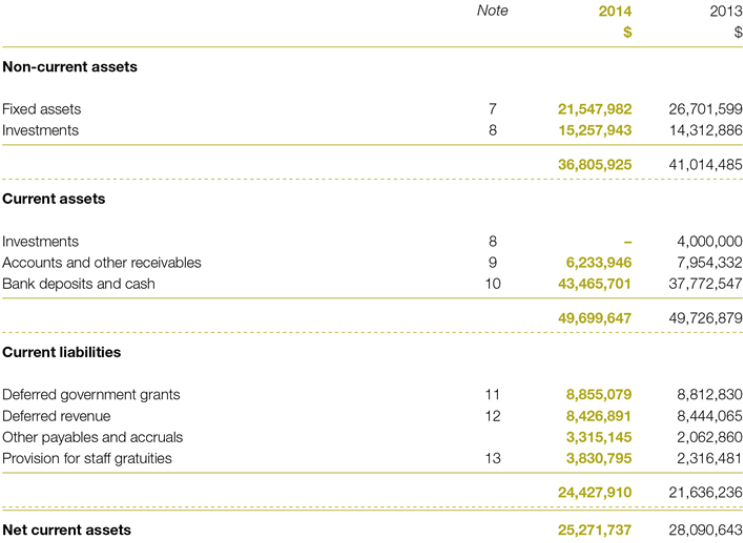

Our accountant is certified and has years of experience auditing different companies. Our accountant will prepare statutory audited financial statements, including accounting records, income statements, and cash-flow statements.

2. Financial Statement and Stock Auditing

Our audit arrangement services include monitoring stock balances and transactions throughout the year so that you can rest assured that everything is in order come audit time. Even if a company has been keeping its books manually up until now, it will still benefit from having computerized accounting ledgers and reports to comply with audit requirements and file tax returns on time.

We can create and manage computerized systems for our clients and provide a general ledger, trail balance, and other financial statements.

3. Agreement on company valuation and External Audits

Our company may also assist buyers in arranging for a company valuation and due diligence evaluation, two forms of non-statutory auditing accountancy services that evaluate a company by looking for and naming its flaws and underperforming assets.

4. Review of Current Operations and Internal Auditing

Effective internal control may advance corporate values and reduce business risks, making extensive internal auditing crucial in today’s corporate climate.

Our skilled auditors make it simple for our clients to conduct an internal audit of their business, and they offer expert guidance and actionable recommendations for fixing any uncovered issues.

B. Professional Accounting Services in Hong Kong

Financial success and stability for a business usually depend on competent accounting services. Whether they are just starting or have been around for a while, our clients can count on timely, up-to-date accountancy standards and a wide range of accounting services to help them satisfy their accounting needs and effectively manage their financial performance.

1. Accounts Payable and Receivable System Establishment & Upkeep.

We assist our clients in establishing a state-of-the-art and reliable accounting system to handle all accounting tasks and maintain an orderly archive of accounting records. Essential for finding, analyzing, and keeping tabs on available assets.

Hand over your monthly invoices and vouchers to us, and we’ll prepare the necessary accounting books and records for your clients to keep track of your business’s day-to-day transactions.

Our accountant may also help clients prepare professional monthly and annual financial records such as income and balance sheets.

2. Professional Accounting Advice for Managers.

Our services include assisting businesses in creating a cutting-edge managerial accounting system that may aid with strategic cost management, long-term financial planning decision-making, and corporate tax preparation. In contrast to financial accounting data, management accounting data is only used internally and requires a more advanced internal accounting system.

3. Treasury Accounting Services

We can serve as an authorized signatory on your bank accounts, process cash transactions, and payments when upper management is unavailable, and interact with major financial institutions, among other treasury services.

Contact us if you’re interested in our accounting and auditing services in Hong Kong.

FAQ:

1. Which department conducts tax audits for my company in Hong Kong?

The Inland Revenue Department audits your company’s tax returns.

2. How long should I keep my company transaction records?

Business records must be kept for 7 years from the transaction date.

3. What types of records should I maintain for my business?

Record the assets and liabilities of your company, including financial statements and management accounts, vouchers, bank statements, agreements, invoices, receipts, payroll, and other essential paperwork needed to verify the data in the books of account.

Authorship:

This blog article is created by easyCorp business team and audited by chartered experts before publish. We’re dedicated to sharing useful information about setting up business and taxation in Hong Kong.

Founded in 2007, we were awarded as the “Best Business Partner” by HANG SENG Bank; our customers spread throughout Europe, the United States, the Middle East, Asia, Africa and etc.

easyCorp differentiate ourself as a strong incumbent in this market, our problem solving experience and numbers of scenario cases handled are not matchable by other market players. We provide high-quality taxation, accounting, company secretary & business consulting services.