Dive into Hong Kong’s dynamic business scene, a beacon for entrepreneurs eyeing the horizon of possibility. As moving into 2024, the promise of growth is as vast as the skyline, with corporate tax in Hong Kong offering a lucrative lure for savvy investors and business minds. As a hub of innovation and fiscal advantage, navigating the corporate landscape in this city isn’t just smart—it’s strategic.

This article provides a detailed look at Hong Kong’s corporate tax rate in 2024, including the prevailing tax system, options available to companies, provisional tax considerations, and exceptions that may apply. Ready to transform your vision into victory? Let Hong Kong’s entrepreneurial ecosystem be the springboard for your success story!

The Territorial Principle and Corporate Taxation

Central to Hong Kong’s tax system is the territorial principle, which states that only profits sourced within Hong Kong are subject to taxation. Profits Tax, also known as Corporate Tax, is calculated on the assessable profit earned during a standard fiscal period, typically spanning twelve months.

Corporate Tax Rates – Single-Tier and Two-Tier Systems

In 2024, Hong Kong maintains its competitive edge with a straightforward corporate tax structure. The city offers two primary corporate tax rate options:

Single-Tier Corporate Tax Rate

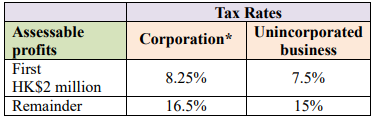

Hong Kong companies are subject to a flat rate of 16.5% on their assessable profits, regardless of the profit amount. This rate is a hallmark of the city’s tax regime, providing clarity and predictability for businesses. For unincorporated entities, such as partnerships and sole proprietorships, the tax rate stands at 15%.

Two-Tier Corporate Tax Rate

Introduced in the fiscal year 2018/19, the two-tier system offers a lower tax rate for the first HK$2 million of assessable income. Specifically, companies can benefit from a reduced tax rate of 8.25% on this portion of their income. Any profit exceeding the HK$2 million threshold is taxed at the standard rate of 16.5%.

This two-tiered approach aims to support small and medium-sized enterprises (SMEs) by lessening their tax burden and fostering a business-friendly environment.

Provisional Profit Tax

The Provisional Profit Tax is a mechanism used by the Hong Kong Inland Revenue Department to streamline tax collection, particularly when companies delay their tax filings. Based on previously submitted Profit Tax Returns or market estimates, the department may issue provisional assessments demanding payment of a specified amount.

Should a company end up paying more tax than required, it is eligible for a tax credit that can be applied to the subsequent fiscal period, ensuring that businesses are not overtaxed.

Offshore Tax Status for Hong Kong Companies

Hong Kong’s tax system offers provisions for companies that conduct their operations entirely outside of the territory. These companies can apply for offshore tax status, exempting them from the Profits Tax. The Inland Revenue Department assesses each case, and companies may need to provide substantial evidence proving that their business activities are conducted beyond Hong Kong’s jurisdiction. Upon approval, these companies are relieved from the obligation to pay the Profits Tax.

Tips for Business Owner

Individuals enjoy tax allowances and deductions, with taxable income starting at a rate of 2% for the first HK$50,000 and capping at 17% for amounts exceeding HK$200,000.

- Stay Organized – Keep accurate and up-to-date records of all financial transactions. This includes invoices, receipts, contracts, and any other documentation that can support your tax filings.

- Understand Your Eligibility – If your company operates outside of Hong Kong, investigate whether you qualify for offshore tax status to potentially reduce your tax liability.

- Utilize the Two-Tier Tax System – Small and medium-sized enterprises should take full advantage of the lower tax rate on the first HK$2 million of assessable profits under the two-tier system.

- Plan for Provisional Tax – Set aside funds for Provisional Profit Tax to avoid cash flow issues. This estimated tax is based on the previous year’s profits and will need to be settled during the current year.

- Seek Professional Advice – Tax laws can be complex and subject to change. Consult with a tax advisor or accountant who is well-versed in Hong Kong tax law to ensure you’re benefiting from all available deductions and allowances.

- File On Time – Avoid penalties by ensuring that all tax filings are done before the deadlines. Late submissions can result in unnecessary fines and interest charges.

Review Tax Incentives and Deductions – Regularly review the latest tax incentives or deductions that may apply to your business, such as those for research and development, environmental protections, or new technologies.

Conclusion

As we navigate through 2024, Hong Kong continues to be an appealing destination for businesses due to its favorable tax system. The city’s commitment to maintaining a low and simple tax structure, complemented by strategic incentives like the two-tiered tax rate, positions it as an economically vibrant metropolis for both local and international enterprises.

For a more in-depth understanding of Hong Kong’s tax rates and regulations, including the latest updates and changes, it is always recommended to consult the Hong Kong Inland Revenue website or seek professional advice from tax specialists.

Ready to Launch Your Business in Hong Kong?

If that entrepreneurial fire is kindling inside you, we’re ready to fan the flames. Reach out to us, and together, we’ll navigate the company incorporation process, establish your corporate bank account, and set you on a confident course in this exciting venture. Contact Us Now!

Contact us now for more details: https://www.easycorp.com.hk/en/incorporations

Authorship:

This blog article is created by easyCorp business team and audited by chartered experts before publish. We’re dedicated to sharing useful information about setting up business and taxation in Hong Kong.

Founded in 2007, we were awarded as the “Best Business Partner” by HANG SENG Bank; our customers spread throughout Europe, the United States, the Middle East, Asia, Africa and etc.

easyCorp differentiate ourself as a strong incumbent in this market, our problem solving experience and numbers of scenario cases handled are not matchable by other market players. We provide high-quality taxation, accounting, company secretary & business consulting services.