Understanding the intricacies of the profit tax return (PTR) process in Hong Kong is essential for both established businesses and newcomers to the region. This process involves reporting taxable income, and it is crucial for maintaining transparency and compliance within the jurisdiction’s tax system.

What Is A Profit Tax Return (PTR)?

Profit tax return is a tax document to report your (company) taxable income. The Profit tax return form is prepared with certified accounting firms and records the taxable income earned over a specific accounting period, usually covering a twelve-month duration. Submitting a PTR (Profits Tax Return) guarantees the precise and punctual reporting of taxable income, further bolstering Hong Kong’s standing as a jurisdiction with a transparent and effective tax system.

In general, approximately 1.5 years (18 months) after a company has commenced its business operations, it will receive its first Profits Tax Return (BIR51) issued by the tax bureau. Unlike the second tax return or subsequent tax forms (which have a one-month deadline if not extended), the first tax return offers a more extended tax filing period and can be submitted within 3 months of its issuance.

Profit Tax Return And Tax Year

The tax year in Hong Kong runs from April 1 to March 31 of the following year. This fiscal cycle corresponds with Profit Tax Returns (PTRs) and enables businesses to harmonize their financial and tax reporting with the April-to-March cycle. This stands in contrast to the more typical calendar year from January to December, which is employed in many other countries.

During a tax year, a business operating in Hong Kong carries out its financial operations, generates income, and accrued expenses. As the tax year concludes on March 31, the company will need to prepare and submit its Profit Tax Return (PTR) for this particular tax year.

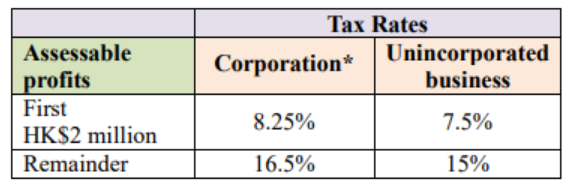

Corporate Tax Rate And Two-Tier Profit Tax Rate

As per the current tax regime, the standard tax rate for corporations is 16.5% on their profits. However, under the two-tiered profits tax rates system, there is a reduction for the first $2 million of assessable profits, where the tax rate is lowered to 8.25%. This is is aimed at providing tax relief to smaller corporations. On the other hand, unincorporated businesses, which include sole traders and partnerships, are taxed at a slightly lower rate of 15%. This difference in rates is one of the many nuances of the Hong Kong tax system, and understanding these details can help businesses plan their financial affairs more effectively.

The progressive tax structure creates a competitive environment by providing smaller enterprises with a reduced tax burden, while larger companies continue to bear the standard 16.5% tax rate. This serves as an incentive to promote and stimulate the growth of small businesses in Hong Kong.

How to File Profits Tax Return

The process of filing a corporate profits tax return in Hong Kong typically commences with the release of income tax returns in April, often within the early part of the month. Upon receiving the Profit Tax Return (PTR), taxpayers usually have a one-month window to request a statutory extension if necessary. For example, if the Hong Kong fiscal year starts on April 1, 2021, and concludes on March 31, 2022, the PTR is typically issued on March 1, 2022. Understanding the timing and deadlines is crucial, as it ensures that businesses can accurately prepare and submit their corporate tax returns within the specified timeframe, thus averting potential penalties or compliance issues.

Filing The Profit Tax Return In Hong Kong Involves Several Steps:

Prepare Your Financial Statements – You’ll need to have your balance sheet, profit and loss statement, and auditor’s report ready. Make sure these documents provide a clear and accurate picture of your company’s financial situation.

Calculate Your Assessable Profits – Determine your assessable profits by subtracting allowable deductions from your net profits. This includes expenses incurred in the production of profits and depreciation allowances.

Complete the Tax Return Form – This form requires you to provide details about your business and your assessable profits. Be sure to fill out all sections accurately to avoid potential penalties.

Attach Required Supporting Documents – This may include invoices, receipts, contracts, and other business records. These documents serve as proof of your income and expenses.

Profit Tax Exemption And Nil Return

In Hong Kong, it’s essential for every taxpayer to submit their tax returns promptly to the Internal Revenue Department. There is a common misconception that businesses not conducting operations within Hong Kong are exempt from filing profit tax return (PTR). This misunderstanding can result in tax complexities, increased tax obligations, and potential legal consequences for companies.

Conclusion

In navigating the Hong Kong tax landscape, staying well-informed about tax laws, regulations, and recent developments, like the Two-Tier Profits Tax Rates Regime, is essential. By adhering to the tax requirements accurately and keeping up with the dynamic tax environment, businesses can ensure they remain on the right side of the law and minimize tax liabilities, contributing to the continued success of Hong Kong’s transparent and efficient tax system.

Tax Return Services in Hong Kong

In conclusion, profit tax returns are important to any company in Hong Kong. And professional tax return services offer benefits like ensuring financial transparency, integrity, and compliance. With the support of accounting and audit service providers like Easycorp, conducting an accurate profit tax return becomes much more accessible.

Contact us now for more details: https://www.easycorp.com.hk/en/incorporations

Authorship:

This blog article is created by easyCorp business team and audited by chartered experts before publish. We’re dedicated to sharing useful information about setting up business and taxation in Hong Kong.

Founded in 2007, we were awarded as the “Best Business Partner” by HANG SENG Bank; our customers spread throughout Europe, the United States, the Middle East, Asia, Africa and etc.

easyCorp differentiate ourself as a strong incumbent in this market, our problem solving experience and numbers of scenario cases handled are not matchable by other market players. We provide high-quality taxation, accounting, company secretary & business consulting services.